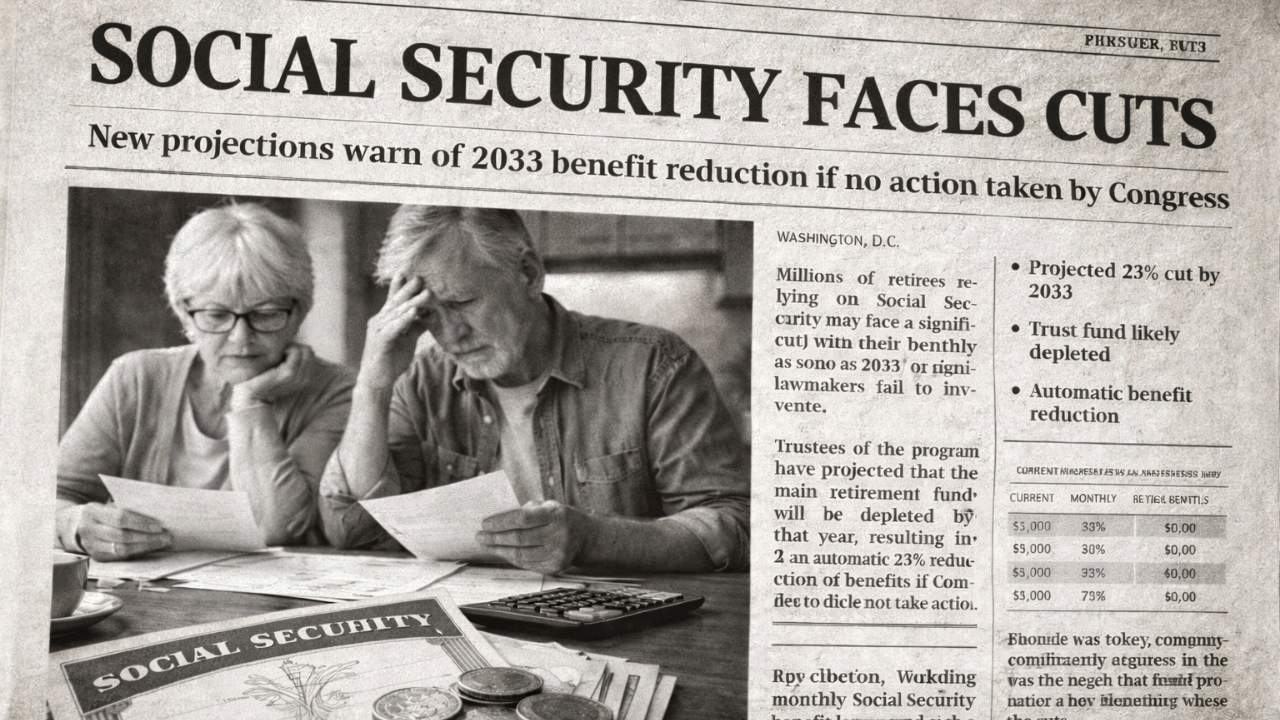

Social Security remains one of the most important financial lifelines for older Americans, providing monthly income to millions of retirees who depend on it to cover basic living expenses such as housing, food, and medical care. For many households, these payments are not just a supplement but the primary source of financial stability after leaving the workforce. However, new long-term financial projections have raised serious concerns about the program’s ability to pay full benefits in the future.

Recent estimates from the Social Security Trustees indicate that the main retirement trust fund could exhaust its reserve balance by the year 2033. If no legislative solution is introduced before that time, the system would be required by law to reduce benefit payments to match payroll tax revenue collected. This would result in an automatic reduction of roughly 23 percent for all beneficiaries.

Such a cut would arrive at a time when seniors are already facing rising healthcare costs, higher insurance premiums, and persistent inflation in everyday goods and services. The possibility of losing several hundred dollars per month has intensified public debate and renewed attention to the program’s long-term sustainability. While the projected reduction is not immediate, it serves as a warning signal that without reform, Social Security’s promise of stable retirement income could weaken in the coming decade.

Table of Contents

Why the Trust Fund is Approaching Depletion

Social Security is funded primarily through payroll taxes paid by workers and employers. These contributions are deposited into trust funds that pay monthly benefits to retirees, survivors, and individuals with disabilities. When annual tax revenue is not enough to cover benefit payments, the system relies on accumulated reserves to make up the difference.

According to current projections, the Old-Age and Survivors Insurance Trust Fund will deplete its reserves by 2033. After that point, Social Security will still receive payroll tax income, but that income will only be sufficient to pay about 77 percent of scheduled benefits. Federal law does not allow the program to borrow funds, meaning payments would have to be reduced automatically unless Congress passes new legislation.

This situation does not mean Social Security will disappear. It means that benefits would be limited to what the system can afford based solely on incoming revenue.

How a 23 Percent Cut Would Affect Monthly Payments

The proposed reduction would apply equally across all benefit levels, but the financial impact would vary depending on how much a retiree currently receives. For individuals living on fixed incomes, even a modest decrease could significantly affect their ability to manage monthly expenses.

Estimated Impact of a 23 Percent Reduction

| Current Monthly Benefit | Estimated Reduction | New Monthly Benefit |

|---|---|---|

| $1,200 | $276 | $924 |

| $1,500 | $345 | $1,155 |

| $2,000 | $460 | $1,540 |

| $2,500 | $575 | $1,925 |

For retirees who depend heavily on Social Security, these losses could force difficult choices about healthcare, housing, and daily necessities.

Demographic and Economic Reasons Behind the Shortfall

The projected funding gap is driven by long-term changes in population and employment patterns rather than sudden policy failures.

Several structural factors are responsible:

- The baby boomer generation has entered retirement, increasing the number of people receiving benefits.

- Birth rates have declined, resulting in fewer workers paying into the system.

- Life expectancy has increased, meaning benefits are paid for longer periods.

- Payroll taxes apply only up to a set earnings limit, restricting growth in contributions from higher-income workers.

These combined trends have shifted the balance between money entering and leaving the system, placing increasing pressure on the trust fund.

Interaction of COLA and Medicare Premiums

Even without future cuts to the trust fund, many seniors already experience limited financial relief because of the relationship between benefit increases and healthcare expenses.

Social Security benefits are adjusted each year through a Cost-of-Living Adjustment (COLA) designed to offset inflation. For 2026, the COLA is projected to be 2.8 percent. However, Medicare Part B premiums are also rising, and these premiums are typically deducted directly from Social Security payments.

As a result, much of the COLA increase may be absorbed by higher medical costs.

COLA Offset by Medicare Premiums

| Item | Amount |

|---|---|

| Monthly benefit before COLA | $2,000 |

| 2.8% COLA increase | +$56 |

| Example Medicare premium increase | −$40 |

| Net monthly increase | +$16 |

This means that even when benefits rise, retirees may see only a small improvement in actual purchasing power.

Legislative Solutions Under Consideration

Lawmakers have several options to strengthen Social Security’s long-term finances. Historically, Congress has acted before trust fund depletion deadlines, and analysts note that earlier action generally allows for more gradual and less disruptive changes.

Common proposals include:

- Increasing payroll tax revenue by adjusting tax rates or raising the taxable earnings cap.

- Modifying benefit formulas, such as changing retirement ages or slowing benefit growth for certain groups.

Many policy plans combine revenue increases and benefit adjustments to distribute the impact more evenly across generations.

Implications for Retirees and Those Near Retirement

For current beneficiaries, there is no immediate change. Social Security continues to pay full benefits under existing law, and any reduction would only occur if Congress fails to act before 2033.

For individuals approaching retirement age, the projections highlight the importance of understanding how Social Security fits into long-term financial planning. While future legislation could prevent or reduce the size of benefit cuts, the current outlook reflects real financial challenges that cannot be ignored.